- 8349505119 / 20 / 21

1st Floor, Anant Tower, Skyes Extension, Rajarampuri main road, Kolhapur

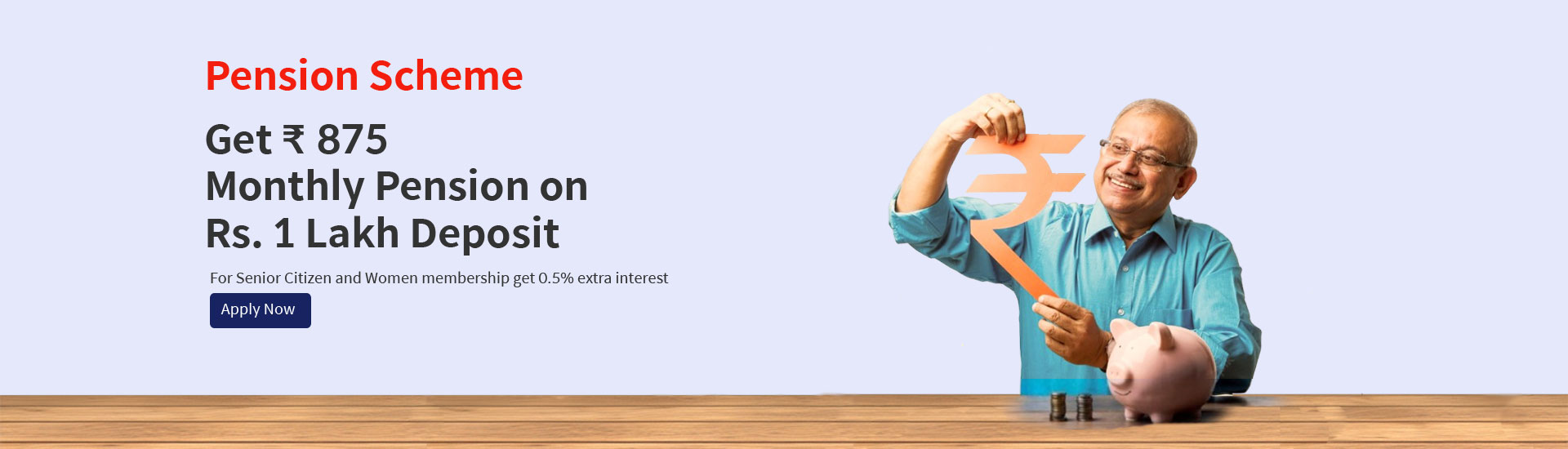

🏦 Pension Deposit Plan – Secure Your Retirement!

💡 Why Pension Savings is Important?

A Pension Deposit Plan ensures financial security after retirement, allowing you to enjoy a **stress-free life with regular income**. With increasing living costs, planning for retirement has become a necessity.

Start saving today and build a solid financial foundation for your future!

✨ Features & Benefits

- ✅ Guaranteed Returns – Earn assured returns on your deposits

- ✅ Flexible Deposit Options – Choose monthly, quarterly, or yearly contributions

- ✅ Secure Retirement – Enjoy a steady pension income after maturity

- ✅ Tax Benefits – Save more with tax deductions on contributions

- ✅ Nominee Facility – Secure your family's future with nominee benefits

📌 Who is Eligible?

- 🔹 Any individual between 18 to 65 years can apply

- 🔹 Salaried employees, self-employed individuals, and business owners

- 🔹 NRIs can also invest (subject to bank rules)

- 🔹 A joint account can be opened with a spouse

📊 Pension Plan Options

| Senior Citizens and Women | ||||

| Fixed Deposit | 1 Year - 10.5 % | 2 Years - 11.5 % | 1 Years - 11% | 2 Years - 12% |

| 50,000 | 437 | 479 | 458 | 500 |

| 1,00,000 | 875 | 958 | 917 | 1000 |

| 2,00,000 | 1,750 | 1,917 | 1,833 | 2,000 |

| 5,00,000 | 4,375 | 4,792 | 4,583 | 5,000 |

| 10,00,000 | 8,750 | 9,583 | 9,167 | 10,000 |

❓ Frequently Asked Questions (FAQs)

The minimum deposit starts at ₹10,000 per month, depending on the plan you choose.

Your pension is taxable based on the income tax laws applicable at the time of withdrawal. Some plans offer tax-free benefits.

Early withdrawals may be subject to penalties or restrictions. However, you can take a loan against your deposit.